Navigating your financial challenges is all about you. While investing wisely is a component of financial planning, to reach your goals we need to first identify them.

Most of our clients have difficulty in defining exactly what their goals are and figuring out where they are now in relation to those goals. Many worry about outliving their money.

Together we determine your desired destination and help you chart the journey there using a combination of wealth tools to help you get above market returns with reduced volatility so you can sleep better at night and enjoy your life.

DC Complete Financial is an independent financial planning broker. Investia Financial is our clearing house for buying and selling your investments. IDCWIN is the clearing house for acquiring insurance products to protect your interests.

Our compensation is via fee for service for non-registered accounts for tax deductibility and embedded for registered accounts (for administrative simplicity) but we will set up a package that is the most tax effiecient and cost effective for your needs.

Meetings

We offer house calls for client meetings and can do more traditional client meetings at our office by appointment only at

Unit 205 -3823 Henning Drive, Burnaby, BC, V5C 6P3

What Clients Say About Us

"Choosing DC Complete Financial as my independent broker was the right choice for us. The depth of knowledge and the access to bank and non-bank investments means I got what I wanted and not what the bank wanted to sell me."

Kerry

"Everything you talked about made sense and I want to move forward. You've saved me a ton of time trying to figure out what to do to improve my financial situation."

Gloria

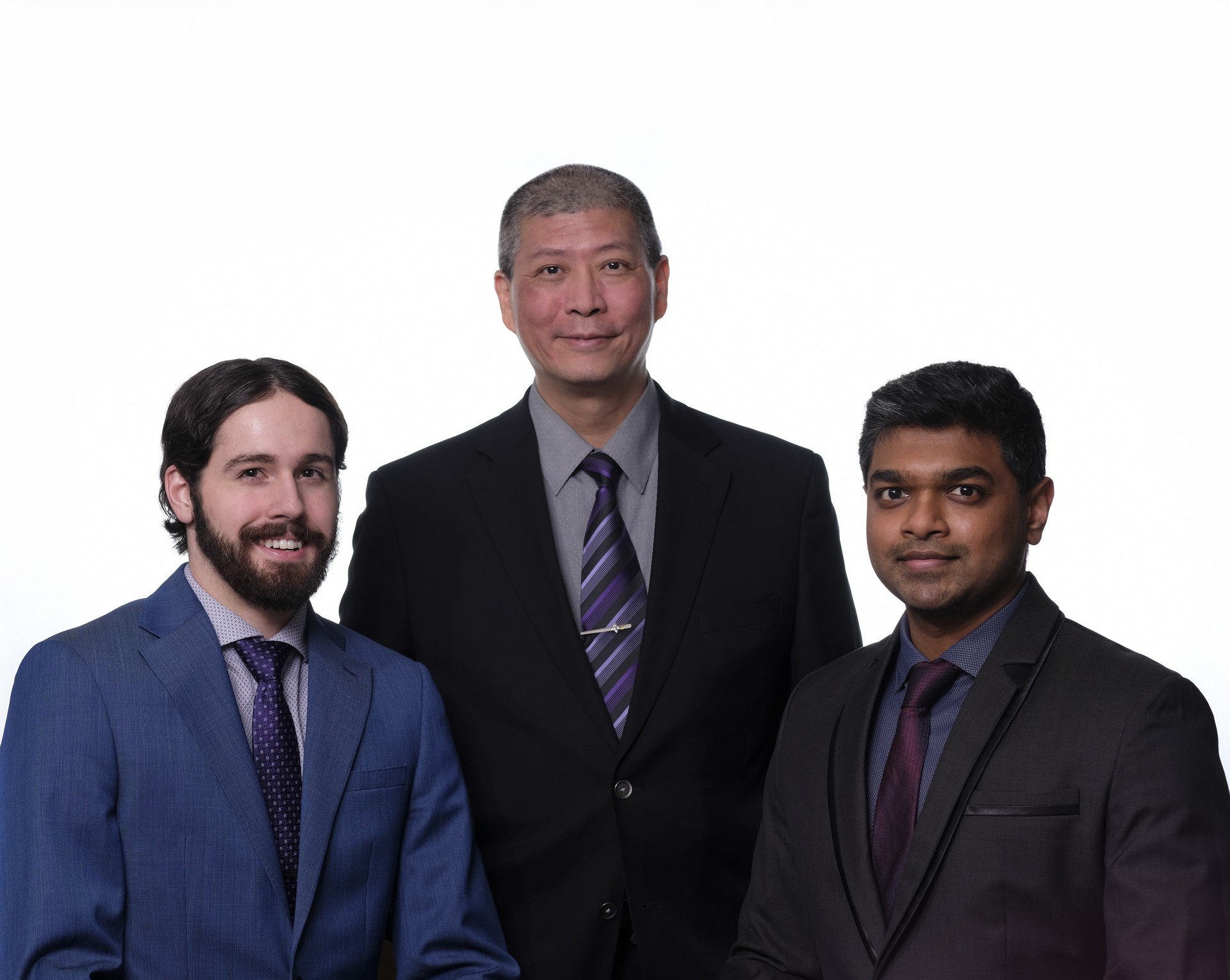

David Chen

BSc, BA, CFP®

Lead Planner

David started in the industry in 2004 with Pencorp and Sun Life Financial, later choosing to become an independent broker in 2016 in order to be unleashed in searching for the best financial instruments to meet our clients' needs.

He specializes in working with families who have a disabled member along with anyone who is determined to improve their financial situation but might not know how.

His focus is to use ESG investments and financial planning to get higher than market returns for lower risk for our clients

Codey Rivest

Associate Advisor

(On Extended Leave)

Codey is an experienced advisor who comes to us from a chartered bank. He wanted to be able to focus on client needs rather than his organization's needs.

As an army veteran, he understands the financial challenges faced by our military during and after their service. He has unique knowledge about the benefits and services available to CAF members and how to integrate them into civilian financial plans.

He holds an investment fund and he is studying to obtain his life license, CFA and CFP® professional designations.